Have You Calculated Zakat on Gold You Have?

“Those who believe, and do deeds of righteousness, and establish regular prayers and regular charity, will have their reward with their Lord: on them shall be no fear, nor shall they grieve.”- (Surah Al Baqarah, Verse 277) -Have You Calculated Zakat on Gold You Have?

Related Articles :

Zakat is a spiritual giving, according to which the rich and wealthy Muslims are required to pay 2.5% of their total savings and wealth. Hence, Muslim men or women possessing valuable materials like gold are also subjected to Zakat.

Giving Zakat is mandatory to ensure that the gold in your possession is free of all sorts of impurities. However, rich Muslims will only pay 2.5% of the gold they own as soon as it reaches the Nisaab amount. Have You Calculated Zakat on Gold You Have?

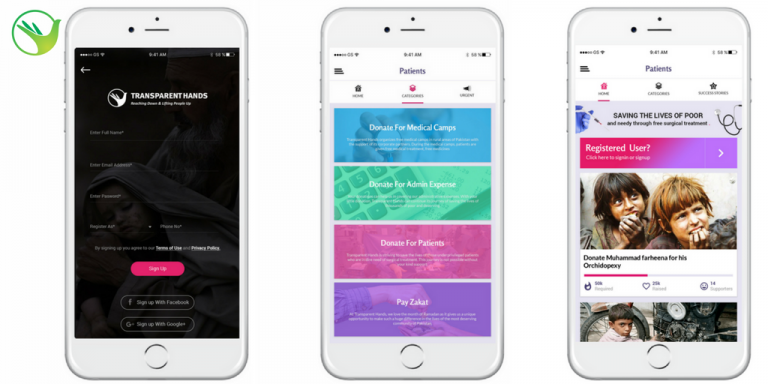

Download our TransparentHands iPhone Application for Online Donation

Nisaab on Gold :

To become eligible for Zakat a Muslim must own 3 ounces or 87.5 grams of Gold for one year. However, if his gold weighs below 87.5 grams then he will not be subjected to Zakat. In order to understand the eligibility to pay Zakat you need to consider these circumstances given below:

A Muslim individual has 120 gram of gold on the 1stof Muharram, 1432 H. He will be obliged to pay 2.5 % of Zakat, on the 1st of Muharram, 1433 H, on the gold he has possessed for the whole year.

A Muslim individual has 120 gram of gold on 1st of Muharram, 1432 H. Now, on the 15thof Shaban month, 1432 H, his gold has reduced to 70 gram. In this case, he will no longer be eligible for paying Zakat.

Hence, he is required to start calculating his Zakat year from 15th of Shaban 1432 to the next 15th of Shaban, 1433H. By this time, if his gold increases above the Nisaab amount then he would be paying Zakat on 15th of Shaban, 1433H.

Calculate Zakat on Gold Using the Online Calculator:

Calculating Zakat seems a difficult task for many of us due to our ignorance regarding the rules and regulations of Shari’ah. This can lead to confusion and we would simply miss out something or unknowingly add more to our calculation. Have You Calculated Zakat on Gold You Have?

TransparentHands Online Zakat Calculator is the best tool available online

Transparent Hands has introduced an online calculator to make our Zakat calculations easier. This online calculator is a simple tool where you are required to insert the following information:

- Bank Savings (amount held for 1 year)

- Credits (money owed to you)

- Loans (money you owe to others)

- Value of shares/stocks/bonds

- Amount of Gold/Silver (Monetary Value)

- Nisaab of silver

The online Calculator will do the Zakat calculations for you after you have provided all the information.

It is not a sin to pay more Zakat but paying less than the required amount is unacceptable. Therefore, it is recommended to use an online calculator to ensure that your Zakat Calculations are 100% error free.

Consequences of Not Paying Zakat :

Allah the Almighty has promised, to reward the Zakat giver Himself due to the kindness and generosity that he has shown to his fellow mankind. Conversely, Allah the Almighty has promised to shower his wrath on the individual who denies Zakat and does not pay it accordingly. This is because Allah likes the grateful and the good doer and strongly dislikes the ungrateful and the wicked.

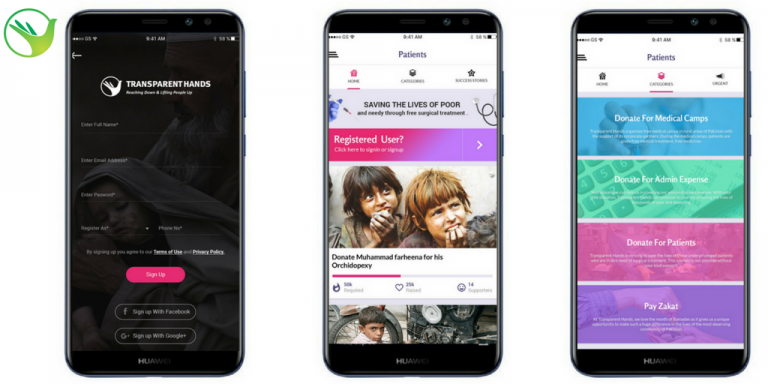

Download our Transparenthands Andriod Application for Online Donation

A person who does not pay Zakat will face severe consequences in the Akhirat as mentioned in the Quran:

“And (as for) those who hoard up gold and silver and do not spend it in Allah’s way announce to them a painful chastisement.

On the day when it shall be heated in the fire of hell, then their foreheads and their sides and their backs shall be branded with it, this is what you hoarded up for yourselves, therefore taste what you hoarded.” (Surah at-Tawba 9: 34-35)

Therefore, all Muslims are bound to pay Zakat in order to gain the blessings and mercy of Allah.

Leave a Reply