Charitable Tax Discount in the United States

The IRS encourages the citizens to donate to charities and gives them a tax break for their generous contribution. Your donations will be considered tax deductible when given to IRS qualified charity reducing your taxable income and costing less on your tax bill.

The IRS allows you to claim your deduction for charitable giving on Schedule A of Form 1040. The Schedule A is used for calculating and itemizing deductions for both charitable donations and other eligible expenses. Tax discount is also available on itemized deductions including medical and dental expenses, lifetime learning expenses, sales tax, and expenditures related to caring for your dependents, home loans, insurance premiums, and home mortgage interest etc.

Charitable tax deductions may pay off for the wealthier taxpayers but every average taxpayer may not leverage from it. Though we have included a few useful tips to help you find a way out, we would always advise you to talk to your legal or financial advisor to make sure there is no mistake and you are extracting the most benefits from your tax deductions.

Charitable Tax Discount in the United States

1 – Donate to Crowdfunding Websites

2 – Donate Non Cash items

3 – Donate food and groceries

4 – Keep the Receipts or Documents

5 – Take a Snapshot of your donated goods

6 – Items that are not tax deductible

-

Donate to Crowdfunding Websites

Crowdfunding websites have become a good way to raise funds faster for charitable campaigns and get more exposure and validation. Many nonprofits now rely on crowdfunding for raising funds within a short span of time and help the recipients immediately.

IRS allows donors to claim tax discount on donations made to the Crowdfunding sitebut it has to be a tax-exempt organization. Some Crowdfunding sites will display their 501(c)(3) status on their project page. There are organizations which may not display their tax exempt status but will put up an official Certified Charity badge under the campaign organizer’s name.

How to Get maximum Tax rebate on Donation in USA

If you can’t find any documents or badge displayed on the project page then possibilities are higher the campaign is being raised for a personal cause. If you donate to such personal campaigns then you won’t be able to claim a tax deduction. According to the IRS if you are not donating to a qualified charity or fundraising site your donations will be considered as personal gifts instead of tax-deductible donations.

-

Donate Non Cash items

You need to calculate the current value of goods or property you donate, including clothes, household items, office equipment, cars, cycles, boats etc and get a written receipt or document from the charity for these noncash items too. You will be required to fill out Form 8283 and mention all the gifted items with your tax return if the items are worth more than $500.

You can claim a tax discount for any item which is in a good working condition and can be used by the charity for a much longer time. If you want to donate a brand new item to a charity make sure you keep the price tag and store the receipt to prove the item’s value and its excellent condition.

-

Donate food and groceries

IRS will also consider your tax discount claims on foods or groceries which you have bought for the charity. Keep the receipt from your grocery shop or restaurant bills to prove the value of the items and ask the charity to give you a written acknowledgment on your donation.

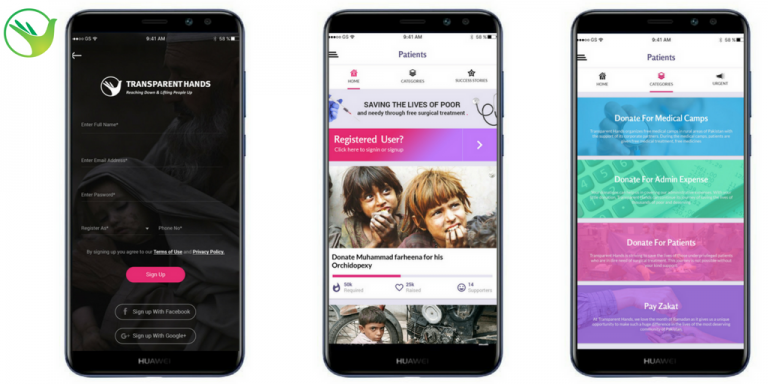

Download our TransparentHands Andriod Application for Online Donation

-

Keep the Receipts or Documents

All your written documents or saved receipts must include the following things to make you eligible for claiming a tax discount on your donation:

- Must have the name of the charitable organization, the date of donation, and the given amount

- Canceled checks will be perfect in this case because it will already have the name of the charity, the date and the amount of the donation

- Debit or credit card statements will work as well because they already show the essential information.

-

Take a Snapshot of your donated goods

Click some quick photos of your donated items separately to keep them as foolproof evidence. This is not a mandatory requirement made by the IRS but it will be helpful as the supporting evidence besides all your written documents.

Just take some quick snapshots on your phone, transfer them to your hard drive and save them for the future audit.

-

Items that are not tax deductible

Check the categories below to make sure that you are donating to the appropriate organization. Items that are not tax deductible include:

- Donations or gifts to individual people

- Donations to political parties, political campaigns or political action committees

- Donations to for-profit schools and hospitals

- Donations or gifts to labor unions, chambers of commerce or business associations

- Donations to foreign governments

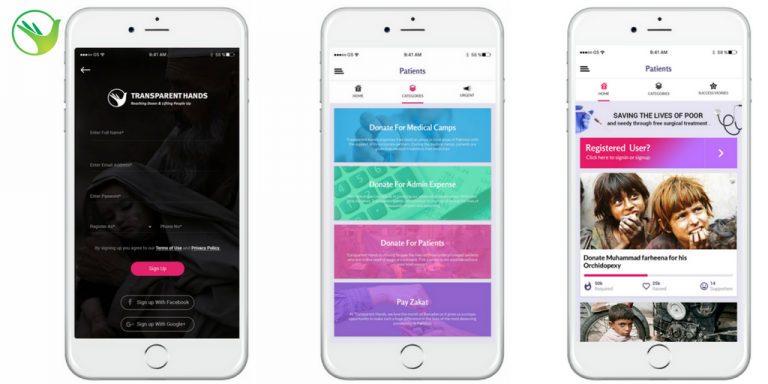

Download our TransparentHands iPhone Application for Online Donation

Leave Your Comments