How to Calculate Zakat on Gold

Zakat is the mandatory giving of a particular proportion of one’s wealth to charity. Zakat is a type of worship that is required for the purification of one’s wealth and soul. Zakat is one of the third pillars of Islam and does not refer to charitable gifts given to the poor out of kindness or generosity. Zakat is a systematic giving of 2.5% of one’s wealth each year to benefit the unfortunate.

Giving Zakat acknowledges the fact that whatever wealth we have we do not really own anything ourselves. Again we cannot take anything with us when we die so we should not cling to it but we should help those who are deserving . Zakat is also a great way to learn self-discipline and it helps to free oneself from the obsessions of possessions and greed.

How to calculate Zakat on gold:

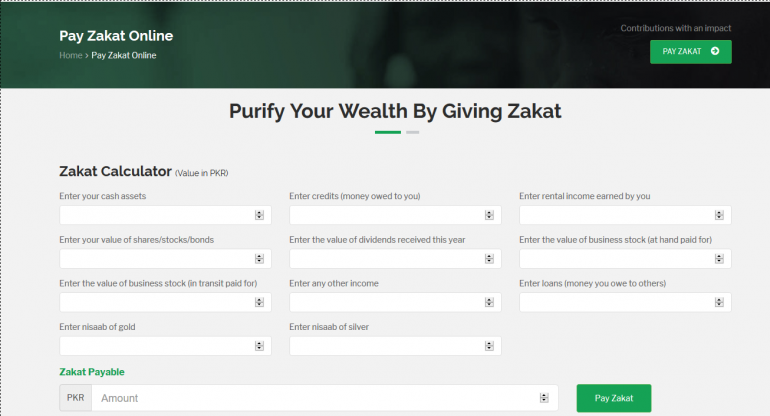

When your personal wealth is more than the Nisab amount, you are obliged to give Zakat. Nisab is the cut-off amount. So when your wealth is below the Nisab, you don’t need to give Zakat. You use either the current market price of gold or silver to calculate Nisab. As the prices of gold and silver fluctuate it is always wise to check the current market rates.

Calculate zakat on gold

When you want to calculate Zakat on gold then the Nisab is the cash equivalent of 3 ounces/87.48 grams of gold

For example, if each ounce of gold is currently worth $43, the Nisab using the gold calculation is ($43X 3 ounces =$129). If your personal wealth is above $129, you owe zakat.

People also face trouble when calculating Zakat on gold jewellery. This confusion mainly occurs due to lack of clear information on the subject. At first you need to know that zakat is only due on gold or silver jewelry. There is no Zakat due on platinum or palladium, Diamonds and gemstones like pearls, sapphires, rubies, corals, etc.

If your gold jewellery is made up of a mixture of metals you are only required to pay Zakat on the gold. You can also give actual gold in Zakat. For example, if someone has gold jewellery that weighs 100 grams, they can give 2.5 grams of gold as Zakat on the jewellery.

If there are diamonds, gemstones, pearls etc, set within your gold jewellery, take it to a professional jeweler when you need to find out the weight of the gold. A professional jeweler will have the knowledge and experience required to assess the weight of the gems and will be able to give you the best approximate weight of the stones. Now to calculate Zakat on your gold jewellery ,you can use this simple method.

The total weight of jewellery – the weight of other stones x the price of gold x 2.5%

Before giving Zakat subtract your monthly expenditures from your zakat eligible assets. For example, your assets for the year total $15,000 and your expenditures total $8,000. So you will be paying $7,000 ($15,000 – $8,000 = $7,000) as Zakat.

Conclusion:

You must keep in mind that Zakat is not a voluntary charity that you are giving to relieve the poverty of the needy people. It is a mandatory act which helps to relieve people’s suffering. Some people believe paying Zakat is voluntary whereas paying taxes is mandatory.

However, this is a misconception. Zakat and tax are two distinct terms. Tax is a mandatory amount you will need to pay to the government. Zakat is an obligatory and spiritual act which is carried out to gain the blessings of the Almighty and obey his commands, so it has nothing to do with the tax laws of your country.

Zakat helps you focus on helping others rather than on your own possessions and needs. It helps you become a better Muslim. In order to get closer to the Almighty, Zakat must be given.

Leave a Reply