Charitable Tax Relief in the United States

We donate cash and noncash items to charity because it gives us satisfaction and mental peace. But at the end of the year, the giving incentives for people were seen to gain a steep rise. People rush to make a charitable donation in order to get a tax relief in the USA.

Wealthy taxpayers who spend thousands of dollars every year for charitable purposes may not be impacted by the tax reformation law because it will still be profitable for them to itemize. However, average taxpayers or small donors may not benefit from itemizing their gifts as the standard deduction scale has risen higher.

The Tax Cuts and Jobs Act law is truly affecting the taxpayers so they need to think of different strategies this year to claim a charitable relief in the USA. Below are some useful tips that you may consider but only after consulting your legal advisor or lawyer.

Charitable Tax Relief in the United States

1 – Create a donor-advised fund:

2 – Donate to Charities to Manage the Increased AGI:

3 – BunchingCharitable Contributions:

4 – M&A markets and Forced CGT:

-

Create a donor-advised fund:

The increasing popularity of the donor-advised fund is attracting Americans to make a smart and efficient charitable giving. The donor-advised funds work in the following way:

- Donate your personal assets permanently

- The charity immediately gives you the maximum tax deduction allowed by the IRS

- Name your donor-advised fund account and authorized advisors, any successors or charitable beneficiaries

- Your assets will be invested into a donor-advised fund account where it will grow tax-free

- You can now grant donations from your account to other qualified charities whenever you want

-

Donate to Charities to Manage the Increased AGI:

In years when you have got an unexpected gain, the stroke of luck will bring along the high amount of tax burden. In your high-income years dive into charitable giving to get rid of overbearing income taxes.

Tips for tax relief on charitable donations in United States

The Tax Cut and Jobs Act Law in 2018 has increased the AGI limit on charitable donations made in cash from 50% to 60% and revoked the Pease limitation. However, the actual calculation works very differently and has no effect on the taxpayer’s incentive to make a generous contribution to charity!

The significant changes in Pease limitation mean taxpayers can claim a greater deduction for greater giving. Your previous donation from a high-incomeyear into a donor-advised fund also counts as a greater giving and compensate your deductions in the less income year.

-

BunchingCharitable Contributions:

Donors should consider the method of bunching or bundling their donations into alternate years. The IRS has given freedom to the donors to time the payment of qualifying deductible expenses on their sweet will. Bunching or bundling will maximize the chances of itemizing deductions in alternate years.

You can contribute a chunk of your donation to the charity during the first part of the year then prepay the next year’s full amount in the month of December of the current year, doubling your entire donated amount in one year. This will cost you no deduction for charity in the successive year. If you use this method you should inform the charity that your double gift is meant for the two-year period.

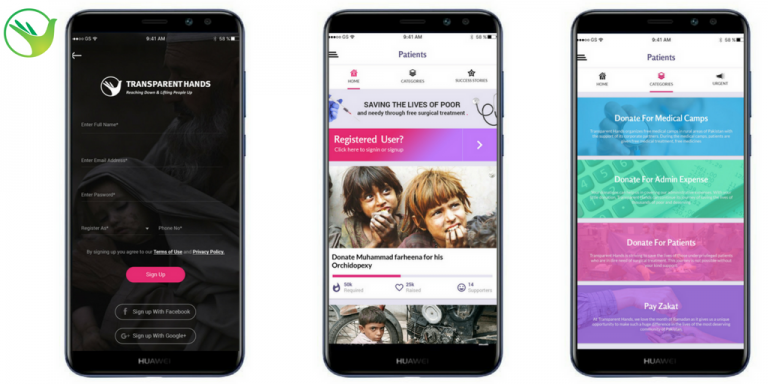

Download our TransparentHands Andriod Application for Online Donation

You can mail thecheck to a charity and it will be considered deductible in the year you have mailed it. You may use your credit card to make the contributions and the charge on your card will be deductible in the year you were charged. You may also use your phone or other wireless money transfer options to make the donation and it will be deductible in the year the contribution is charged on the phone or the wireless account.

-

M&A markets and Forced CGT:

In 2018, Investors will be subjected to Capital Gains Tax even if they do not wish to sell a property. The current rising prices of shares and newly reduced corporate tax rate will create a lucrative environment for them to build active mergers and acquisitions which in turn will expose them to Capital Gains this year.

M&A investors should watch out and make a smart move before they accumulate the forced capital gains. Donating appreciated assets to charity can be a smart way to eliminate the CGT- a headache from your tax return statement this year.

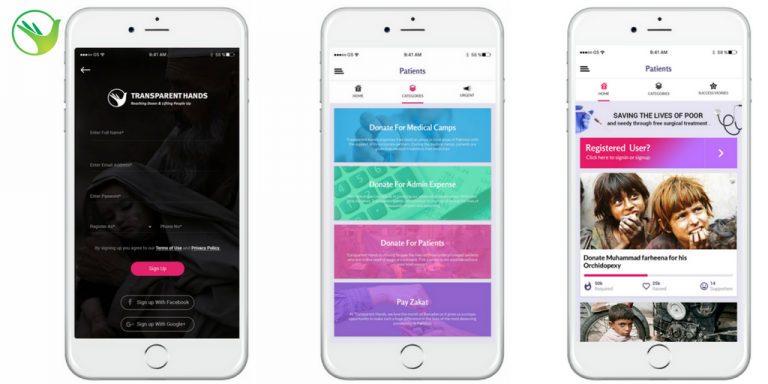

Download our TransparentHands iPhone Application for Online Donation

Leave Your Comments