How to Get Maximum Tax Rebate on Donation in USA

Our generous charitable donations are valuable because they help to lighten the burdens of millions of people in this world who are forgotten, uncared and unloved. While giving to charity can make us feel good it also helps us to save some extra cash at the end of the year.

The IRS acknowledges the charitable efforts of the citizens, thus, allowing them to make tax deductions on charitable donations which reduce the gross taxable income of the taxpayer costing less on the tax bills.

Generally, taxpayers considera charitable donation to be the best way to receive a deduction on their taxable income but getting a tax deduction in 2018 will be much difficult compared to the previous years.

Charitable tax deductions are made based on the amount set as the standard deduction. In the past taxpayerswere required to itemize (deduce the expenses allowed by the IRS which will decrease the taxable income) to make sure that it is surpassing the standard deduction.

In 2018 the range of standard deduction has gone higher on the scale. According to the new regulations marked on the Tax Cuts and Jobs Actslaw, the standard deduction for single filers will be $12,000. For the heads of household it will be$18,000 and for a married couple filing togetherit will be $24,000.

Charitable tax deductions may pay off for the wealthier taxpayers but every average taxpayer may not leverage from it. Though we have included a few useful tips to help you find a way out,we would always encourage you to talk to your legal or financial advisor to make sure there is no mistake and you are extracting the most benefits from your tax deductions.

How to Get Maximum Tax Rebate on Donation in USA

1 – Donate using an IRA (Individual Retirement Account)

2 – Donate to Qualified Charitable Organization

3 – Donate to Crowdfunding websites:

4 – Noncash donations

5 – Donate using a mobile phone

-

Donate using an IRA (Individual Retirement Account)

If you have a 70-1/2 status you can use your IRA to receive a tax deduction. In this method, your IRA custodian will transfer the money to a qualified charitable organization from your account and you may qualify under the QCD act (Qualified Charitable Distribution) which will lower the range for your Adjusted Gross Income costing less on your tax bills.

Tax relief tips for charitable contributions in USA

This method does not assure a 100% tax deduction. It might work out if you consult your financial adviser to understand the loopholes in the tax law. You should also discuss other possibilities of how an IRA donation may affect you or the limitation imposed on the amount of donation you can transfer to make sure you are on the right track.

-

Donate to Qualified Charitable Organization

Donating to a qualified organization means to make sure that the charity is a tax-exempt 501c3 organization. This kind of charitable giving is more beneficial for wealthier taxpayers.

If you choose to donate to organization make sure you pay by the 31st December in the year in which you are planning to claim your tax deduction. Your donation will be marked as paid after you had sent the check through the mail or the amount was already charged onyour credit card.

-

Donate to Crowdfunding websites

Donating to Crowdfunding websites will also qualify for tax deduction but basing on strict regulations.

There are numerous Crowdfunding websites at present serving different purposes. Some fundraising websites help to raise donations for entrepreneurs, small businesses, scientific projects, medical bills, personal causes etc while other websites are solely dedicated to raising funds for nonprofit campaigns and there are a few supporting both for-profit and nonprofit categories.

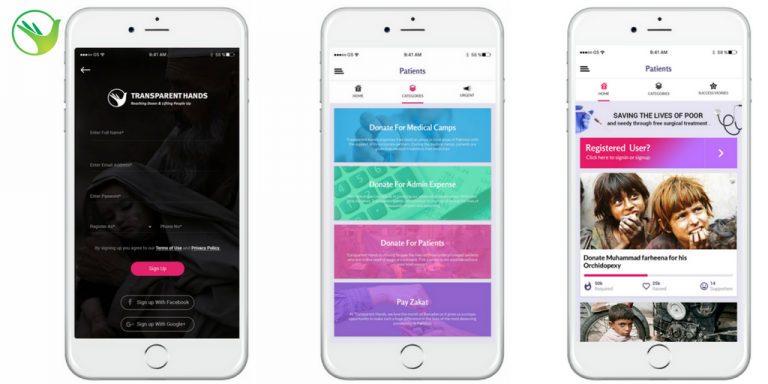

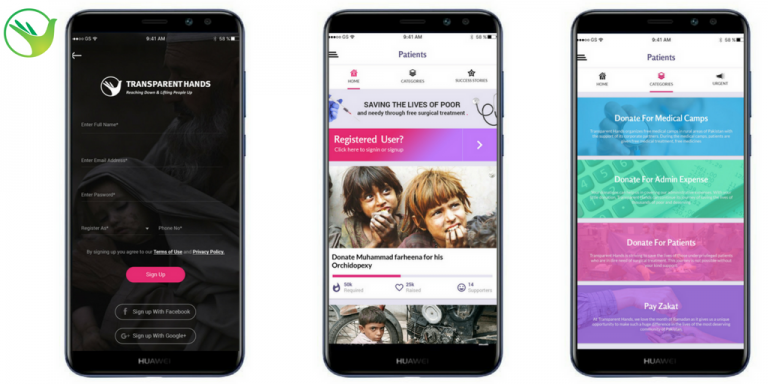

Download our TransparentHands Andriod Application for Online Donation

Do a research on the Crowdfunding sites, check their policies and find out the types of campaigns they support before making a donation. The IRS will only allow tax deductions under this category if you contribute to a tax-exempt qualified nonprofit organization .. You should check the official website for some sort of verification of the tax status of the nonprofit before making your valuable contribution.

If you support a Crowdfunding campaign which is run to help an individual, a business, or any other project,you will be considered ineligible for a charitable tax deduction.

-

Noncash donations

Now that the standard deduction scale has inflamed much higher tax payers may not leverage from all sorts of noncash donations like clothing, household furnishings, office equipment or property etc.

It will be a wise move to assess your itemized deduction under this category carefully and see whether it is beneficial for you or not. It is better to get a qualified assessment when you are donating a bulk of items worth $500 or more.

If you own a property like a land for more than a year which you do not intend to use anymore you may donate it to a charitable organization and receive a tax deduction equaled to the fair market value of your property.

-

Donate using a mobile phone

You can make a donation using your mobile phone toa charity and use the phone bill as your receipt or evidence in case of an audit conducted by the IRS. Make sure your phone bill lists the date, the amount donated and the name of the charity on it to verify your donation.

When you donate to a charitable organization via texts the nonprofit cannot view your personal details and you will be considered as an anonymous donor. The charity won’t provide you a receipt but the amount donated will be recorded on your phone bill.

Download our TransparentHands iPhone Application for Online Donation

Leave a Reply