How to Get Maximum Tax Relief on Donation in USA

Taxpayers usually rush to make a charitable donation to claim a tax-exempt in the USA.Tax deduction on charitable donation is beneficial because it reduces the gross taxable income of the taxpayer cost less on the tax bills.

The IRS will let you take the standard deduction by default if you do not have any qualifying deductions or tax credits. The standard deduction is good for reducing your gross income on which you owed your income tax. The IRS also allows you to itemize your deductions on someexpenses to decrease your taxable income but at any given time you can only choose a single deductible method.

Make a careful assessment before choosing any deductible method. If your itemized deduction seems to save you more money compared to the standard deduction, then you should opt out for the first one. If the standard deduction seems to be more profitable compared to the itemized one, you should head for the standard deduction to save your time and energy.

How to Get Maximum Tax Relief on Donation in USA

1 – Donate to Qualified Organizations by IRS:

2 – Required Documentsto claim the Deductions:

3 – Out of pocket expenses for charitable work:

4 – Deduction on Mortgage or Home Equity Loan:

5 – Other Tax Returns:

-

Donate to Qualified Organizations by IRS:

Charitable deductions are allowed only on donations which were given to organizations qualified under the501(c) (4) status. However, donations to an international government, political campaign, political party, an individual etc are ineligible for a tax deduction. You can only claim your tax deduction on donations if you donate to the IRS qualified organizations as mentioned below:

- Tax-exempt educational institute or organization

- Tax-exempt medical research center and hospital

- Federated funds including community chest supported by the public

- A private foundation which donates from their collected funds to public or private charities.

- A Membership Organization which collects more than one-third of their contributions from the civilians

- Churches and religious organizations

-

Required Documentsto claim the Deductions:

If you are really interested to claim a tax deduction on your charitable giving then you should keep all your receipts and verified documentation to support your claim. No matter how much you donate to organizations or spend for the welfare of the society if you do not have evidence you cannot ask for a tax exemption.

Charitable Tax discount in the United States

You may be audited by the IRS and during this time you will be required to show a canceled check, credit card statement, bank statement or a written acknowledgment from the organization as a substitute to your donation.

Make sure you estimate the value of any donor incentives given to you by the charity.The organization must include the exact amount of the gifted item in your receipt so that you can estimate the amount of your donation above that value.

-

Out of pocket expenses for charitable work:

When you are volunteering for any organization make sure you keep a record of every expense you have paid out of your own pocket. The IRS gives you the freedom to deduct expenses like telephone bills, catering bills, cost of uniforms etc.

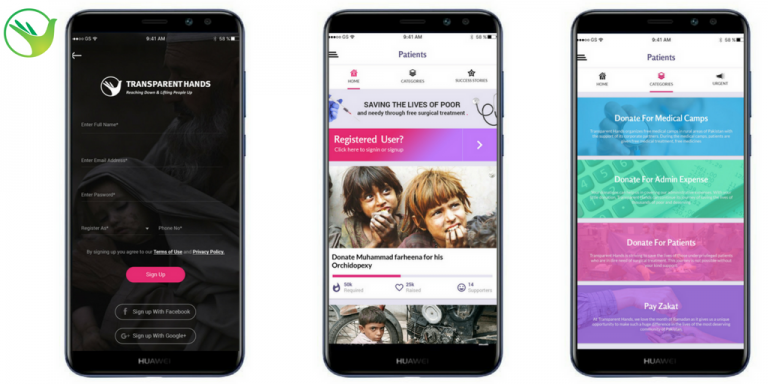

Download our TransparentHands Andriod Application for Online Donation

When you make a long distance call on behalf of the organization you are allowed to deduct the full cost of your call charges. If you host an event on behalf of the charity like attending a sponsor or a board meeting you can deduct the catering expenses you have made as a charitable deduction.

If volunteers stay away from home a few days they can deduct all the expenses related to the charity’s work such as transportation, lodging or dining expenses.

-

Deduction on Mortgage or Home Equity Loan:

IRS will allow claiming a tax deduction on your personal expenditures as well.

When you have a mortgage or home equity loan you should check with your financial advisor to see whether itemizing this cost could save you more money. Usually, your mortgage company will issue you the Mortgage Interest Statement at the end of the year. Calculate your mortgage interest deduction amount against the standard deduction to see if you can claim a tax-exempt under this category.

-

Other Tax Returns:

If you are eligible for other tax returns including property taxes or sales taxes you can claim a tax-exempt on your federal taxes. Your sales tax can become a good option to save some extra cash. If you purchase an expensive item like a car, engagement ring or any other precious stuff you are allowed to itemize these costs to take the tax deduction on the expenditures.

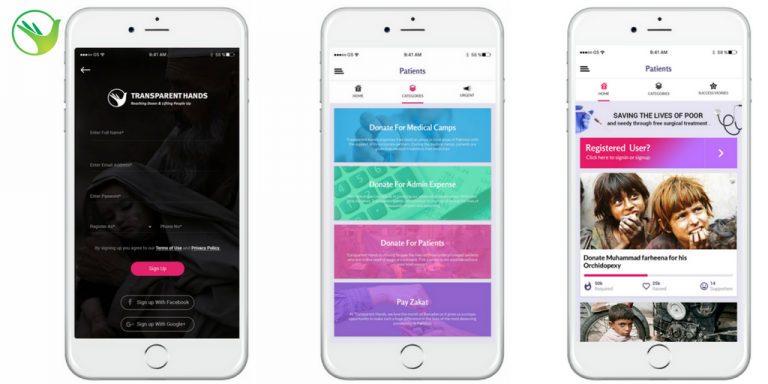

Download our TransparentHands iPhone Application for Online Donation

Leave Your Comments