How to Make Sure Your Charity Donations Are Tax Deductible in USA

2018 has marked the start for new tax laws with some alterations which may not benefit every taxpayer. The Tax Cut and Jobs Act law have important implications for your taxable income if you are interested to make a charitable contribution this year.

While taxpayers still have the option to make a charitable deduction and claim a tax rebate on it but individually the ability to claim the charitable tax rebate will vary a lot depending on whether the taxpayer has sufficient itemized deductions to surpass the standard deduction amount.

People usually expect huge deductions on their charitable donations but in reality, your charitable contributions will reduce your tax bill to some extent offering some decent savings.

Tax laws and regulations are complicated and its implication may vary depending on every individual’s personal income and other circumstances so it is always a good decision to consult an attorney or tax professional regarding your specific tax situation.

How to Make Sure Your Charity Donations Are Tax Deductible in USA

1 – Itemized Deductions:

2 – Planning Deductions:

3 – Pease Limitations:

4 – M&A Deals:

5 – Donate private S-corp or C-corp stocks to charity:

6 – How federal Tax Bracket may affect deductions:

1 – Itemized Deductions:

Charitable deductions will work best when you can itemize other deductions as well which means after you make a charitable contribution you must look for other personal deductions to exceed the standard deduction amount. The most common personal expenses that qualify are:

- Mortgage interest

- State and local tax

- Caring for Elderly Parents

- Medical and dental expenses

- Student loan interest

- Earned Income Tax Credit (EITC)

2 – Planning Deductions:

To get a maximum tax rebate on your charitable donations, plan the following steps:

- Only donate to a non-profit organization that is qualified asa 501(c)(3) public charity or private foundation.

- Keep a record of the contribution (the tax receipt, canceled checks, credit card bills, etc).

- Your non-cash donation should be assessed carefully to prove the value of your claimed deduction

- Get all the paperwork done before itemizing and filing your tax return.

3 – Pease Limitations:

The Pease limitations are no longer included in the new law as it has been removed from the tax code.

Maximum Tax Relief on charitable donation in USA

In 2017, the Pease deductions were used to reduce 3% of taxable income surpassing the $261,500 amount for single individuals. For example, an individual donor had an income of $1,500,000 and deducted only $50,000 in charitable donations. In 2017 the Pease Reduction calculation had worked in the following way:

[($1,500,000 income – $261,500 threshold) x 3%]=37,155.

This Pease reduction calculation had allowed him to deduct $37,155 from his $50,000 gift into the tax statement making him adjust up to $12,845 on his financial benefits.

However, the Pease limitation has been suspended for 2018-2025 tax years. This significant change in the tax law will obviously help the wealthy taxpayers as the standard deductions scale has gone higher this year.

4 – M&A Deals

The rise in M&A deals globally will attract many investors to join in because these transactions can bring in additional income. Now additional income will increase your tax liabilities which means your extra income will be subjected to capital gains tax.

M&A investors should watch out and make a smart move before they accumulate the forced capital gains. Donating appreciated assets to charity can be a smart way to eliminate the CGT from your tax return statement this year.

5 – Donate private S-corp or C-corp stocks to charity

You can claim the charitable deductions on S-corp and private C-corp stock among other assets and will be able to deduct the full market value of the stock if the beneficiary organization is a public charity.

Before donating your stocks make sure your selected charity has the capability, resources, expertise to liquidate these types of assets, especially at the end of the year.

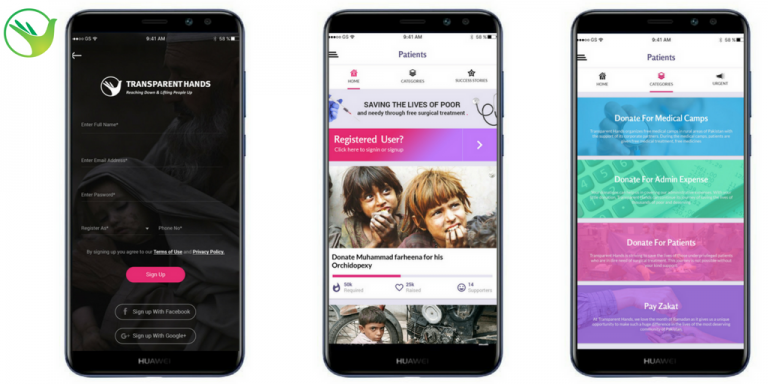

Download our TransparentHands Andriod Application for Online Donation

6 – How federal Tax Bracket may affect deductions:

The United States law abides by the progressive tax system and the taxpayers are classified into different tax brackets based on their taxable income. Your income tax rate will increase proportionally to your taxable income. The higher your tax bracket, the greater will be your tax savings. Consider this example:

Maria earns $90,000 and falls in the $82,500 to $157,500bracket, which means she has to pay 24% of that portion of her income in taxes. So she will have to pay $21,600 for this bracket (24% of $90,000).

For 2018, that amount of standard deduction is $12,000 for a single person. This deduction will work when she will subtract that amount from the total amount of income she has earned for the year.

So, Maria’s income for tax purposes will be $(90000-12000) or $78,000. Now after the standard deduction, she falls in the 22% tax bracket which is $38,700 to $82,500. Due to her reduction in the tax bracket, she will be paying (22% of $78,000) or $17,160 as income taxes to the IRS.

If Maria donates $15,000 to a charity and decides to deduct her contribution instead of taking the standard deduction her final taxable income will be ($90,000-15,000) or $75,000.

Maria still falls in the 22% tax bracket so she will be paying (22% of $75,000) or $16,500 to the federal government as taxes. So her charitable deductions will only save her $660 on her tax bills.

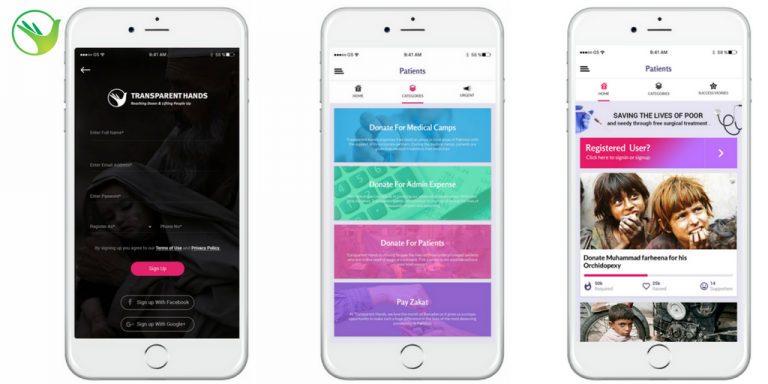

Download our TransparentHands iPhone Application for Online Donation

Leave Your Comments