Kiva Microfunds – A Non-Profit Organization

This Article contains the following information about Kiva Microfunds – Non-Profit Organization:

1- What is Non Profit Organization (NGO)

2-Introduction of Kiva

3- What makes Kiva Unique?

4- How Kiva Works?

5- Where Kiva works?

6-Kiva’s Financials

7-Kiva’s Organizational structure

8-Kiva’s Due diligence and monitoring

9-Kiva’s risks of lending

10-Kiva’s Repayment rate stats

11-Kiva’s Field Partner risk

12-Kiva’s Direct loan risk

13-Kiva’s Country risk

14-Kiva’s Currency risk

15-Kiva-related risks

16-Kiva’s Due diligence for direct loans

17-Kiva’sOngoing monitoring

18-Kiva’s role

What is Non-Profit Organization?

In economic terms, a nonprofit organization uses its surplus revenues to further achieve its purpose or mission, rather than distributing its surplus income to the organization’s shareholders (or equivalents) as profit or dividends.

Example of Non-Profit organization like kiva

Introduction of Kiva

Kiva Microfunds (commonly known by its domain name, Kiva.org) is a 501(c)(3) non-profit organization that allows people to lend money via the Internet to low-income entrepreneurs and students in over 80 countries. Kiva’s mission is “to connect people through lending to alleviate poverty.”

Since 2005, Kiva has crowd-funded more than a million loans, totaling over $1 billion, with a repayment rate of between 98 and 99 percent. As of November 2013, Kiva was raising about $1 million every three days. The Kiva platform has attracted a community of well over a million lenders from around the world.

Kiva operates two models—Kiva.org and KivaZip.org. The former model relies on a network of field partners to administer the loans on the ground. These field partners can be microfinance institutions, social businesses, schools or non-profit organizations. KivaZip.org facilitates loans at 0% directly to entrepreneurs via mobile payments and PayPal. In both Kiva.org and KivaZip.org, Kiva includes personal stories of each person who needs a loan because they want their lenders to connect with their entrepreneurs on a human level.

Kiva itself does not collect any interest on the loans it facilitates and Kiva lenders do not make interest on loans. Kiva is purely supported by grants, loans, and donations from its users, corporations, and national institutions. Kiva is headquartered in San Francisco, California.

Kiva is an international nonprofit, founded in 2005 and based in San Francisco, with a mission to connect people through lending to alleviate poverty. Kiva celebrates and support people looking to create a better future for themselves, their families and their communities.

By lending as little as $25 on Kiva, anyone can help a borrower start or grow a business, go to school, access clean energy or realize their potential. For some, it’s a matter of survival, for others it’s the fuel for a life-long ambition.

100% of every dollar you lend on Kiva goes to funding loans. Kiva covers costs primarily through optional donations, as well as through support from grants and sponsors.

Kiva’s History

Kiva was founded in October 2005 by Matt Flannery and Jessica Jackley. The couple’s initial interest in microfinance was inspired by a 2003 lecture given by Grameen Bank’s Muhammad Yunus at Stanford Business School. Jessica Jackley, worked at the school and invited Matt Flannery to attend the presentation; this was the first time Flannery had heard of microfinance, but it served as a “call to action” for Jackley. Soon after, Jackley began working as a consultant for the nonprofit Village Enterprise, which worked to help start small businesses in East Africa.

While visiting Jackley in Africa, Flannery and Jackley spent time interviewing entrepreneurs about the problems they faced in starting ventures and found the lack of access to start-up capital was a common theme. After returning from Africa, they began developing their plan for a microfinance project that would grow into Kiva, which means “unity” in Swahili. In April 2005, Kiva’s first seven loans were funded, totaling $3,500, and the original entrepreneurs were subsequently deemed the “Dream Team.”

By September 2005, the entrepreneurs repaid the entirety of their original loans, and the founders realized they had developed a sustainable micro credit concept. After the success of Kiva’s initial stage, Flannery and Jackley founded Kiva as a non-profit. In 2006, notable entrepreneurs and businessmen joined Kiva’s staff, including Premal Shah from PayPal and Reid Hoffman CEO and founder of LinkedIn.

Shortly after its first anniversary in October 2006, Kiva reached $1 million in facilitated loans and acquired its twentieth field partner. Citation needed To the present day, Kiva has continued to grow and expand its field partners while acquiring support from the media and the public.

What makes Kiva unique?

It’s a loan, not a donation

They believe lending alongside thousands of others is one of the most powerful and sustainable ways to create economic and social good. Lending on Kiva creates a partnership of mutual dignity and makes it easy to touch more lives with the same dollar. Fund a loan, get repaid, fund another.

You choose where to make an impact

Whether you lend to friends in your community, or people halfway around the world (and for many, it’s both), Kiva creates the opportunity to play a special part in someone else’s story. At Kiva, loans aren’t just about money—they’re a way to create connection and relationships.

Pushing the boundaries of a loan

Kiva started as a pioneer in crowdfunding in 2005, and is constantly innovating to meet people’s diverse lending needs. Whether it’s reinventing microfinance with more flexible terms, supporting community-wide projects or lowering costs to borrowers, they are always testing and learning.

Lifting one, to lift many

When a Kiva loan enables someone to grow a business and create opportunity for themselves, it creates opportunities for others as well. That ripple effect can shape the future for a family or an entire community.

How Kiva Works?

Kiva allows microfinance institutions, social businesses, schools and non-profit organizations around the world, called “Field Partners”, to post profiles of qualified local entrepreneurs on its website. Lenders browse and choose an entrepreneur they wish to fund. The lenders transfer their funds to Kiva through PayPal, which waives its transaction fee in these cases. It is possible to pay by credit card through PayPal’s website, even without a PayPal account, but a PayPal account is needed to withdraw funds.

After receiving a user’s money, Kiva aggregates loan capital from individual lenders and transfers it to the appropriate Field Partners, who then disburse the loan to the entrepreneur chosen by the lender.

Even though Kiva itself does not charge interest on the loans, the Field Partners charge relatively high interest rates. Interest is typically higher on loans from microfinance institutions in developing countries than interest rates on larger loans in developed countries because of the administrative costs of overseeing many tiny loans, and the increased risk.

As the entrepreneurs repay their loans with interest, the Field Partners remit funds back to Kiva. As the loan is repaid, the Kiva lenders can withdraw their principal or re-lend it to another entrepreneur.

Following steps tells that how kiva works.

- A borrower applies for a loan

- The loan goes through the underwriting and approval process

- The loan is posted to Kiva for lenders to support

- Fundraising period:

- Lenders crowd fund the loan in increments of $25 or more.

- Fundraising complete!

- Borrower repays the loan

- Lenders use repayments to fund new loans, donate or withdraw the money.

- Where Kiva works

Kiva’s Supporting Areas

Female-owned businesses

As of April 1, 2012, 80.46% of Kiva’s loans have been made to female entrepreneurs. Kiva emphasizes supporting women because women can gain the most from microcredit. Patriarchy and a strict division of labor still dominate the societies of many developing countries, and women often suffer the most from poverty because scarce resources are often allocated to a family’s males, rather than its females. In their non-fiction book Half the Sky, Nicholas D. Kristof and Sheryl WuDunn tell stories of women whose lives were transformed through the microfinance institutions Kiva sponsors.

With microloans, women gain spending power and spend less on instant gratification vices like alcohol, prostitution, and drugs. With extra income, they are able to educate their children, renovate their residences, or buy modern technologies and medicines.

Along with economic power, a woman with a microloan often gains more independence and respect from her husband. Kristof and WuDunn write “microfinance has done more to bolster the status of women, and to protect them from abuse, than any laws could accomplish.”

Green loans

In 2011, Kiva added a new category of loans to help borrowers move to cleaner and safer forms of energy, green agriculture, transport and recycling. Green Kiva loans help fund solar panels, organic fertilizers, high-efficiency stoves, drip irrigation systems, and biofuels. As of December 2013, Kiva lenders had crowd-funded 4,600 green loans.

Access to clean cook stoves is an environmental issue and a global health concern because 4 million people die each year from indoor pollution from burning wood, coal or animal waste to cook and warm their homes.

Drip irrigation systems conserve water to increase crop yield in areas where water is scarce for agriculture. About 600 million subsistence farmers lack irrigation water worldwide.

Solar lamps replace kerosene and candles used for light. The solar lamps cost about $20 and can last several years. About 1.3 billion people on the planet have no access to electricity, and indoor use of kerosene lamps can result in respiratory illness.

Support for higher education

Getting access to university and graduate level education is extremely difficult for poor students in developing countries. Outside of the United States and a few other wealthy industrialized countries, student loans are rare, leaving families without substantial savings with few options. In low income countries, only 7% of the population received university or graduate level education, as of 2007.

Higher education has been shown to play a significant role in development in a country, and UNESCO reports that “higher education makes a significant contribution to reduction in absolute as well as relative poverty,” in a country.

In 2010, Kiva began a Student Microloans program that allowed lenders to help support students seeking access to higher education. Student loans are funded with the same crowd-funding approach, and typically students have 1–3 years to pay back their loans.

In 2014, the education offerings on Kiva expanded greatly when the organization began a deeper partnership with Vittana. Vittana works on the ground in countries in Asia, Africa and Latin America, developing loan alternatives for low-income students. Through the partnership, all loans sourced by Vittana now appear on Kiva for funding and the dual partnership could reach 20,000 students.

Support for refugees

In July 2017, Kiva launched a World Refugee Fund, a $250,000 matching fund to provide support to refugees and host communities in countries including Lebanon, Jordan, and Turkey. As refugees repay the loans, they will build a track record in their new locations. The fund is to be followed by a rotating fund of up to $9M in loan capital.

Where Kiva works?

Kiva serves borrowers in more than 80 countries on 5 continents. They’re headquartered in San Francisco, with offices in Nairobi and staff stationed around the world. They also have incredible volunteer fellows working in the field throughout the year.

In addition to all these dedicated Kivans, they would not be able to reach so many communities and scale their impact without the extensive network of Field Partners and Trustees who help connect us with borrowers.

Field Partners do incredible work– they screen borrowers, post loan requests to Kiva for funding, disburse loans on the ground and collect repayments. Most Field Partners are microfinance institutions, but they can also be schools, NGOs or social enterprises. They all share one thing in common: the desire to improve people’s lives through safe, fair access to credit.

Trustees endorse loans, vouching for borrowers who want to apply for direct loans on Kiva, which are loans that aren’t administered by Field Partners.

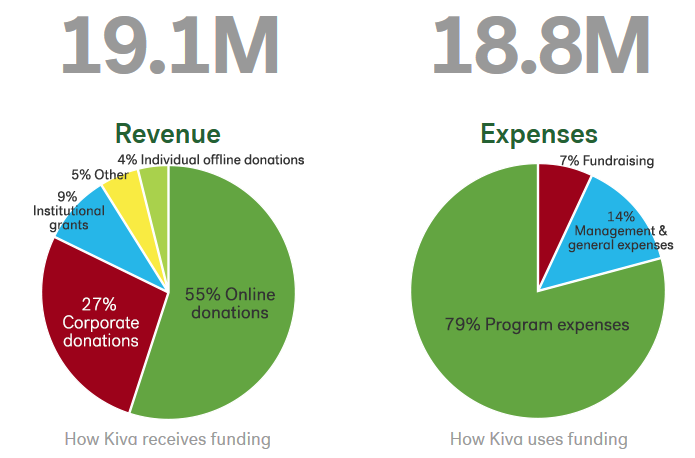

Kiva’s Financials

Kiva is a 501(c)(3) nonprofit, based in California, with a 4 out of 4 star rating from Charity Navigator. Sustainability, transparency and efficiency are at the core of their work, their mission and their financial model.

100% of your loans go to borrowers

Kiva never takes a fee from lenders, which means 100% of the funds you lend on Kiva go to supporting borrowers’ loans. They also do not charge any interest or fees to borrowers or their Field Partners working on the ground in more than 80 countries.

Additional donations cover Kiva’s operating cost

Kiva covers operating costs primarily through the generosity of their lenders, who can choose to make donations in addition to loans. They cover more than two-thirds of their operating costs through these voluntary donations from Kiva lenders. The remainders of their costs are covered through grants and donations from foundations and supporters.

This model of fundraising helps promote sustainability, by keeping their fundraising costs low and tapping into the power of the crowd to help cover their costs.

Kiva Awarded for Effectiveness and Efficiency

Kiva’s staff and volunteers work hard to ensure every dollar donated to Kiva is used efficiently, and they’ve received recognition for their commitment.

Kiva’s Organizational structure

While making a loan on Kiva may seem like a simple thing, there’s a lot that goes on behind the scenes. As such, Kiva is structured as 3 separate entities:

- Kiva Microfunds is based in California and registered as a 501(c)(3) nonprofit organization. All donations made to Kiva go to support Kiva Microfunds and are used to cover the operating costs of running Kiva.

- Kiva User Funds LLC is a separate entity that holds all funds belonging to Kiva users in FDIC-insured, escrow-like bank accounts. These low-yielding FBO accounts were set up to ensure Kiva users’ funds (meant for lending) are protected and fully separated from Kiva’s operational funds.

- Kiva-DAF LLC is a third entity that was created to hold donor advised funds to facilitate lending on Kiva’s platform for Kiva’s institutional partners (such as charitable foundations).

Kiva’s Due diligence and monitoring

Kiva takes due diligence and monitoring very seriously as part of their responsibility to lenders and borrowers. They encourage all lenders to learn about the risks of lending on Kiva as Kiva does not guarantee repayment on any loans. Lending on Kiva may involve loss of principal, for a variety of reasons including if the borrower doesn’t repay, the Field Partner doesn’t repay or from currency loss.

The level of due diligence relevant to a specific loan on Kiva depends on a variety of factors, including how the loan is administered. Most loans on Kiva are administered by one of their local partners working in more than 80 countries. Kiva conducts due diligence on all Field Partners prior to allowing them to begin posting loans on the Kiva platform. To learn more about this process visit their Field Partner due diligence page.

Almost all Kiva loans for borrowers in the U.S. are direct loans, which are not administered by a Field Partner. This gives Kiva the ability to reach populations that even micro lenders can’t or don’t serve, but it also means these loans often involve a higher level of risk or default. To learn more about the due diligence for these U.S. loans, please visit the due diligence page for direct loans.

Kiva’s risks of lending

Microloans reach populations that have limited access to financial services, so these types of loans come with some inherent risks for lenders. When you lend money on Kiva, you may lose some or all of your principal. You should be aware of the different types of risk (some of which are outlined below) and find the right loan option for you, with respect to repayment risk and social return.

Kiva’s current repayment rate is reflected below. The “overall repayment rate for all loans” includes all loans in all countries, including loans that were repaid or defaulted and loans that are currently paying back. It also factors in currency loss. Please note that past repayment performance does not guarantee future results. To review the terms that apply to your use of Kiva, please see their terms of use.

In order to help reduce your risk exposure, you may wish to diversify your Kiva portfolio, thus reducing your exposure to any one borrower, Field Partner or country. For example, instead of placing $100 with 1 borrower, you may wish to place $25 with 4 borrowers in different countries.

Kiva’s Repayment rate stats

- Repayment rate for all loans: 97.0%

- Repayment rate for ended loans only: 97.9%

- Repayment rate for partner facilitated loans: 97.2%

- Repayment rate for direct U.S. loans: 81.8%

- Borrower repayment rate for all loans: 97.5%

- Currency exchange loss rate: 0.5%

Kiva’s Borrower risk

Borrowers on Kiva are vetted or endorsed by either a local Field Partner, Trustee or members of the community.

Kiva’s loans administered by a Field Partner

The partner looks at a variety of factors (past loan history, village or group reputation, loan purpose, etc.) before deeming a borrower as credit-worthy. However, a number of factors can result in borrowers defaulting, such as:

- Business issues (such as crop failure, liquidity issues or demand for goods)

- Health issues (such as malaria, cancer or physical disability)

- Other issues (such as theft, paying for school fees, over indebtedness, reduced remittances, civil disturbances, etc.)

If a borrower defaults, Kiva Field Partners are expected to pursue collections according to their normal practices. In addition, Kiva asks and expects that all of their Field Partners adhere to the client protection principles from the Smart Campaign.

Learn more about the Field Partner’s role in reviewing loan applications and administering your loan.

Kiva’s direct loans

Borrowers are endorsed by either a Trustee organization or members of their community in a process we call social underwriting. A borrower must either:

- Have the endorsement of a Kiva Trustee, an organization or individual that works to connect borrowers with Kiva

- Or successfully invite members of their own social networks to support their loan before the loan is able to fundraise publicly on Kiva

Because their own connections, friends and family are putting their own dollars in, we believe social underwriting builds borrowers’ commitment to repaying their loans. However, direct loans can default for all of the same reasons as Field Partner loans, and with direct loans there is no Field Partner pursuing repayments.

Lenders should be aware that direct loans involve a higher level of risk of default than loans administered through Field Partners for various reasons, including less monitoring and follow up for collection of repayments as well as the stage of business. Many direct loan borrowers are start-up businesses in their first years of operation, which is a particularly challenging and critical time for businesses.

Kiva’s Field Partner risk

Most of the loans on Kiva are administered by a Field Partner, which means the funds are distributed through one of their local partners working in the community.

The funds are also repaid by borrowers through the Field Partner. While working with Field Partners increases the likelihood that your loan will be effectively used and repaid, new institutional risks are introduced. Even if a Kiva borrower is able to repay, Kiva lenders could still lose principal due to Field Partner issues such as:

- Bankruptcy (the Field Partner may go out of business and be unable to collect your loan)

- Fraud (staff members at the Field Partner may embezzle funds)

- Operational difficulties (the Field Partner may have some cash-flow or other challenges that could prevent repayment)

Before working with a Field Partner, Kiva performs due diligence on the organization to help assess this risk.

Kiva’s Direct loan risk

Direct loans on Kiva are not administered by a Field Partner. There are some great benefits to direct loans: for example they are 0% interest to the borrower. But they are also at higher risk of default because there is no Field Partner working on the ground to follow up with the borrower and encourage or collect repayments.

Many direct loan borrowers are also startup businesses in their first years of operation, which is a particularly challenging and critical time for businesses.

Kiva’s Country risk

When lending internationally it is important to consider “macro-level” risks:

- Economic (a large currency devaluation – or the institution of exchange controls by local governments – may reduce or render the Field Partner’s local currency collections valueless for you).

- Political (many loans posted on Kiva are disbursed in the developing world. Policies can change regarding funds repatriation or even the requirement that borrowers have to repay their loans).

- Natural disasters such as a flood, tsunami or drought may greatly reduce the likelihood of loan repayment from certain countries or from specific regions in a country.

Kiva currently targets a country limit of no more than 10% of total loans outstanding to help ensure a balanced portfolio. Individual lenders may want to consider the country and regional balance of their own portfolios as well. In certain instances, the Kiva-imposed limit is lifted on a temporary basis.

Kiva’s Currency risk

While Kiva’s working currency is the U.S. dollar, many loans are disbursed to borrowers in their local currency, thus adding an additional risk to lenders, especially in times when the U.S. dollar is strong. Please determine if currency exchange loss is possible for a loan. For loans with currency risk possible, lenders bear the risk of loss if the U.S. dollar appreciates by more than 10% against the local currency.

Additionally, if your home currency is not the U.S. dollar, another layer of currency risk is added because loans made through Kiva must be in U.S. dollars. Therefore, the initial conversion from your home currency to USD will add foreign exchange risk.

Note: foreign exchange risk is not present if your local currency is the U.S. dollar and loans are disbursed in U.S. dollars

Kiva-related risks

There is a potential risk that Kiva, like any organization, may not continue its operations indefinitely. To better protect lenders’ funds in this circumstance and others, Kiva holds lender funds separately from its own operational funds. When lenders have available funds in their Kiva accounts (for example funds that have been repaid, or funds that have been deposited and not yet lent), these funds are held in bank accounts for the benefit of Kiva lenders. They believe that holding lenders’ funds separately from Kiva’s operational funds helps protect these funds from being subject to any claims of Kiva creditors (other than the Kiva lenders who have funds available in the Kiva system).

Kiva’s Due diligence for Field Partner loans

Most loans on Kiva are administered by one of their local partners in more than 80 countries. Kiva conducts due diligence on all Field Partners prior to allowing them to begin posting loans on the Kiva platform.

Kiva partners with a range of organizations, including microfinance institutions, social businesses, schools and nonprofits. These organizations are united by a strong commitment to serving the needs of low-income, vulnerable, and/or excluded populations, either through financial services or by using credit to expand access to products and services.

This page explains the institutional diligence and monitoring for their Field Partners, but lenders should note that a higher institutional risk rating does not necessarily mean that an individual borrower at that Field Partner has a lower risk of default. Please see the risks of lending for more on borrower risk.

Kiva’s Credit tiers

Kiva has developed a system of credit tiers that enables us to work with Field Partners across a broad spectrum of credit needs, from early-stage organizations seeking smaller amounts of capital for borrowers, to larger organizations with extensive credit programs serving many borrowers.

- The level of due diligence conducted on a particular Field Partner is determined by the partner’s credit tier, with a higher level of due diligence required for higher tiers.

- The lowest credit tier comes with a credit line of $50,000. This tier is designed for Field Partners who seek to use Kiva to experiment with small lending programs. In addition, many new Field Partners, regardless of size, start in this tier in order to try Kiva before scaling their program. Because the level of due diligence conducted on a Field Partner in this tier is comparatively light, less is known about the level of risk they pose; hence, these Field Partners are labeled as “Experimental” on Kiva’s website.

- A Field Partner in the highest credit tier can access a credit line of up to $4 million. The highest tier is reserved for Field Partners who have large funding needs and a demonstrated track record. Kiva conducts its most comprehensive level of due diligence for a Field Partner in this tier.

- A Field Partner that starts at a lower credit tier is eligible to graduate to higher tiers as it utilizes its credit line and grows its Kiva program. In order to graduate to a higher tier, the organization must undergo the corresponding level of due diligence.

Kiva’s Due diligence process

Step 1: Review application from potential Field Partner

An organization that seeks to partner with Kiva must first submit an application, which consists of the following:

- Detailed information about the organization, including its mission and history, products and services, governance and management, and technical and operational infrastructure.

- Specific proposal for using Kiva’s capital to fund loans with high social or environmental impact.

- Supporting documentation, including financial statements, portfolio reports, strategic plans, financial projections, ratings, and impact studies.

To be considered for a higher credit tier, an organization must submit additional documentation, which may include the following, depending on tier: CVs and/or bios of board and management members, organizational manuals, longer-range projections and budgets, and external references.

A Kiva analyst reviews these materials and then follows up with the organization to resolve any outstanding questions and discuss details of the potential partnership.

Step 2: Conduct on-site due diligence (required only for higher credit tiers)

For higher credit tiers, the Kiva analyst will also visit the organization for on-site due diligence. Some organizations may not receive an on-site visit due to risks of traveling to the country where the organization is located. In those cases, the Kiva analyst meets with representatives of the organization in an alternate location or leverages external sources, such as references and other rating information.

During an on-site visit, the Kiva analyst interviews members of the board and management team, loan officers and borrowers. In addition, the analyst reviews documentation, reports and the management information system of the organization.

Step 3: Prepare a due diligence report

After the Kiva analyst has reviewed the potential Field Partner’s application and has completed the on-site visit if applicable, they prepare a due diligence report. This report includes some or all of the following components, depending on the proposed credit tier:

- Organizational overview: A summary of the organization’s mission and history, governance and management, technical and operational infrastructure and proposed use for Kiva funding.

- A review of the pricing structure of each loan product that the organization proposes to fundraise on the Kiva website. Many factors impact what it costs an organization to provide financing, including the local supply of capital, the local currency risk, and the local infrastructure and cost of doing business. There is also a relationship between the size and term of a loan and its average cost: small loans with short terms cost more to administer and thus have a higher average interest rate for borrowers. Due to this complexity, Kiva doesn’t set a firm maximum cost that a Field Partner can charge a borrower for a loan, but we focus the review on ensuring that the pricing is in line with local market context and industry standards.

- Financial analysis: This is created with a financial analysis tool tool that tracks data from the organization’s financial statements and portfolio reports and calculates key ratios. Outputs from the financial analysis tool also feed into the proposed risk rating, if applicable.

- Proposed risk rating: The Kiva analyst proposes a risk rating of between 0.5 to 5 stars to represent the estimated risk of institutional default. To calculate the risk rating, they use Kiva’s risk model, which assesses the organization on a point system based upon the following areas of focus: governance, management, transparency, business model, loan product(s), financials and external factors. A 0.5-star rating means the organization has a relatively higher risk of institutional default, while a 5-star rating indicates the organization is at a relatively lower risk of default, based on their analysis and the available information. (Note that Field Partners in the lowest credit tier undergo a lighter level of due diligence and hence do not receive a risk rating. Instead, in places where a risk rating would normally appear on Kiva’s website, these partners are labeled as “Experimental.”)

- Proposed social performance badges: To represent the Field Partner’s social performance strengths, Kiva uses a social performance scorecard to award social performance badges. They assess the organization on a points system based upon the following areas of focus: Anti-Poverty Focus, Vulnerable Group Focus, Client Voice, Family and Community Empowerment, Entrepreneurial Support, Facilitation of Savings, and Innovation. (Note that Field Partners in the lowest credit tier undergo a lighter level of due diligence and and for that reason are not eligible for social performance badges.)

Step 4: Submit for approval

The Kiva analyst submits the due diligence report to members of Kiva’s investment team, who review the proposal, communicate with the analyst in case of questions, and vote on whether to approve the organization for partnership.

For an approved Field Partner, the investment team also approves the final credit tier, which determines the Field Partner’s credit line.

Kiva’s Ongoing monitoring

Kiva conducts regular monitoring of all Field Partners. The level of monitoring conducted for a particular Field Partner corresponds to the partner’s credit tier, with a higher level of monitoring required for higher tiers.

Monitoring may include some or all of the following activities, depending on credit tier:

- Operational audits to confirm the accuracy of loan and repayment information posted to Kiva’s website.

- Review of updated financial statements.

- Review of updated portfolio data, including cost of loans to borrowers.

- Update of the risk model and associated risk rating, where applicable (Field Partners in the lowest credit tier do not have a risk rating).

- Update of the social performance scorecard and associated badges, where applicable (Field Partners in the lowest credit tier do not have social performance badges).

- On-site visit to meet with management, loan officers and borrowers.

As part of their ongoing monitoring, they may discover some potential issues at a Field Partner. They will work to investigate and resolve the issues as quickly as possible. While they investigate, they may, at times, delay the timing of distribution of a collected repayment to you as a lender until the investigation is resolved.

Kiva’s Possible reasons for a delay include:

- Questions about data accuracy (if Kiva believes that the accuracy of repayment amounts is in question).

- Concerns about creditor claims (if Kiva believes that a Field Partner may be facing solvency issues and there’s a risk that another creditor – such as a government tax authority – may attempt to assert a priority claim on a Field Partner’s assets).

Kiva’s Due diligence for direct loans

Direct loans are an innovative and growing segment of Kiva’s loan portfolio. These loans are not administered by a Field Partner, which gives Kiva the ability to reach populations that even micro lenders can’t or don’t serve. Direct loans are made through the digital payment system PayPal.

Direct loans were launched on Kiva in 2011 and are currently only available to borrowers in the U.S. as they continue to learn more about this model and the most effective ways to scale. Lenders should be aware that direct loans often involve a higher level of risk of default than those administered through Field Partners. The higher risk is due in part to less monitoring and followup for collection of repayments, as well as the nature of the businesses served. For example, many direct Kiva borrowers are startups that are in their first or second year of business.

Kiva’s role

To be eligible for a direct loan on Kiva, borrowers must either be financially excluded (meaning lacking access to financial services for their business) or creating social good through their business. Kiva staff determine if a borrower meets one of these requirements by assessing their loan application.

Kiva requests information about financial history from direct loan applicants, and does a series of checks to help verify their identity, ranging from researching their business online to confirming the PayPal information provided by the borrower. All applicants are screened through the Office of Foreign Assets Control terrorism database as a security precaution

These internal review steps are taken to help prevent fraud, and generate a general sense of the borrower’s financial picture, the viability of their business and its potential social impact.

Kiva’s Social underwriting

In addition to the steps Kiva takes internally, direct loan applicants must also be vetted by a Kiva Trustee or members of their community in a process they call social underwriting. Social underwriting bases a borrower’s creditworthiness on the strength of their personal network and their character, which helps create a more complete picture of a borrower when considered alongside financial history.

This community-based form of due diligence is relatively new and experimental for Kiva, but they believe that when a borrower involves their own connections, friends and family in the loan process, it increases their commitment to repaying their loans.

Kiva’s Trustees

Kiva Trustees can be community organizations or individuals. They help Kiva identify credible direct loan applicants and act as an encouraging force for borrowers as they apply for and repay their loans. Trustees are character references— they may not have experience with lending programs but they do have a relationship with the borrower.

Kiva has a tiered system that allows Trustees to endorse more borrowers and more loans as their recommended borrowers build a history of successful repayment. Trustees must also maintain a target repayment rate among their recommended borrowers in order to continue endorsing new borrowers. Kiva does make some exceptions when pausing Trustees with lower repayment rates based on past working relationships.

Kiva’s Private fundraising period

Every direct loan borrower must also recruit members of their own network to support their loan during a private fundraising period before Kiva will post the loan to the public website. The number of lenders the borrower must recruit may be set anywhere from 5 to 30, depending on the size of the loan, the potential social impact of the loan and whether the loan was endorsed by a Trustee. While many borrowers do have the support of a Trustee, borrowers are not required to have a Trustee endorsement in order to successfully apply for a direct loan on the Kiva website.

While Kiva is still refining this network-driven lending tool, early results show that repayment rates do improve when borrowers invite members of their own communities to support their loans. It also holds potential to help Kiva scale its impact as they continue to expand their work and create more economic opportunity around the globe.

Kiva’s Ongoing monitoring

When a direct loan borrower is behind on repayment, Kiva follows up with multiple repayment reminders, phone calls and emails in order to encourage repayment.

Trustees are expected to encourage borrowers they endorse to repay their loans, though they are not expected to put in the same level of effort or diligence as a Kiva Field Partner. Kiva monitors direct loan repayment rates and will adjust a Trustee’s ability to endorse borrowers based on the historical success of borrowers recommended by the Trustee.

Direct loan borrowers who fail to repay or end up defaulting on their loan are not eligible for future Kiva loans. Direct loans are generally defaulted when the total amount repaid is less than the total amount expected as of 6 months prior.

At the moment, loans are defaulted on a monthly basis and contributing lenders are notified by email. Kiva reserves the right to exempt loans from default if extenuating circumstances are found, or if they believe there is a high likelihood of future repayment. When a loan is defaulted, any amount not repaid should be considered a loss by contributing lenders. While borrowers are still allowed to make repayments after their loan has been defaulted, Kiva does not have the resources to follow up with these borrowers to encourage future repayments.

Leave Your Comments