Tax Relief Tips for Charitable Contributions in USA

A tax deduction is a beneficial way to save some extra cash for your financial security at the end of the year. When you become eligible to get a tax deduction it essentially contributes to reduction in your income which issubjected to state and federal income taxes. The decrease in your total taxable income due to tax deductions hugely reduces the amount of income tax you would have otherwise owed.

IRS allowstax deduction on charitable donations because it encourages the taxpayers to work for charitable causes and contribute to the welfare of the society. Here are a few tax relief tips on charitable donations which will benefit both the taxpayer and the society.

Tax Relief Tips for Charitable Contributions in the USA

1 – Benefit More from Non-Cash Donations:

2 – Stay Cautious when Donating a Vehicle:

3 – Caring For Elderly Parents:

4 – Keep Proper Documentation:

-

Benefit More from Non-Cash Donations:

If you own a property for more than one year you may donate it to an IRS qualified organization to benefit more from tax exemption. IRS will consider the property’s current market value and deduct the whole amount from your taxable income. This is a big advantage because the IRS would not put a tax on an appreciated property which you have donated. As a result,you will receive a big deduction for the amount which you have never reported as income.

How to Get maximum Tax discount on Donation in USA

-

Stay Cautious when Donating a Vehicle:

In the past, many taxpayers had shown the tendency to overestimate the value of their donated vehicles. As a result, the IRS now maintains a strict regulation on such donations. If you donate a vehicle to any organization you must consider its fitness and make sure it is of a decent quality and do value your donation accordingly.

Unlike appreciatedproperty, your car will be valued depending on the price that the charity has received after selling it in the market. So never use the fair market value of your car when claiming a tax deduction on your donation.The IRS will only allow you to use the fair market value on your donated vehicle if the following conditions suit your case:

- Instead of selling the vehicle the organization has keptit and planned to use it on a regular basis

- The organization has reconditioned your car before selling it

- The organization had sold the car to a low-income individual on discount

- The car was worth less than $500

-

Caring For Elderly Parents:

Charity begins at home!

Looking after our elderly parents are one of our ethical and moral family duties and most of us fulfill it as an obligation because we love and respect our elder ones.

When you are caring for your elderly parents you can declare him as your dependent and ask for a tax exemption on the amount you have spent on their wellbeing. If any of your parentsare still an earning member take a closer look at his monthly or yearly income.

You parents cannot earn more than the annual exemption amount (excluding the Social Security Benefits) and must depend on you for half of their living expenses.Even if your parents do not live with you; you can still get a tax deduction as long as you support them financially and pay for their rents, bills, groceries, medicines, and caretakers.

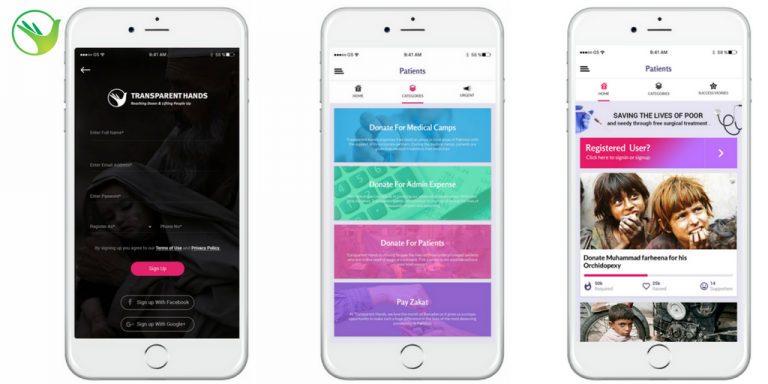

Download our TransparentHands iPhone Application for Online Donation

-

Keep Proper Documentation:

If you are really interested to claim a tax deduction on your charitable giving then you should keep all your receipts and verified documentation to support your claim. No matter how much you donate to organizations or spend for the welfare of the society if you do not have evidence you cannot ask for a tax exemption. You may be audited by the IRS and during this time you will be required to show a canceled check, credit card statement, bank statement or a written acknowledgment from the organization as a substitute to your donation.

You cannot give away your old or unused clothes, furniture, and equipment just out of generosity. If you clearly want to get any tax deduction you must keep a record of each of your donated items and make sure all your donated stuff were in good and decent conditions. The IRS will only consider the deductions for donations of clothing, equipment and household items that were in good condition while donating.

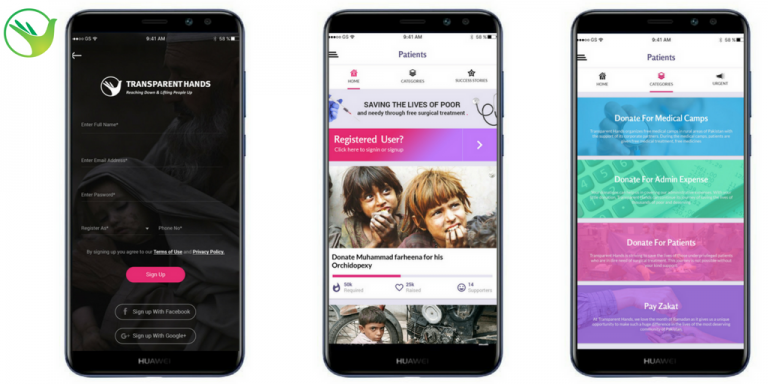

Download our TransparentHands Andriod Application for Online Donation

Leave a Reply