We Can Help You to Calculate Zakat on Gold

“Give charity without delay, for it stands in the way of calamity.” – (Tirmidhi) -We Can Help You to Calculate Zakat on Gold

Zakat is often referred to as charity by many people. However, there is a difference between Zakat and other philanthropic givings. This is because, Zakat is an obligation on the rich Muslims that are bound to fulfill once in every year.

Related Articles :

Every Muslim society views Zakat as a religious matter but only a few of them execute this religious giving in reality. Some governments directly interferes in the religious practices of its citizens, and ensures that Zakat is paid by the high net worth Muslims. On the other hand, the government of the secular countries prohibits from interfering in religious matters so Zakat is given by their citizens voluntarily.

One should bear in mind that giving Zakat is an act of goodness, and is always returned with goodness by the Almighty.Therefore, it is our duty to give it timely regardless of the place where we live.

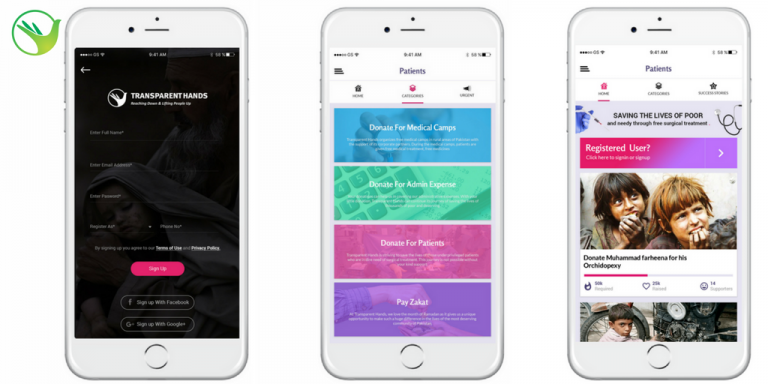

Download our TransparentHands iPhone Application for Online Donation

How to Calculate Zakat on Jewellery ?

If your jewelry is made of only gold or silver then the calculation is fairly simple. Just weigh your jewelry and calculate 2.5% of it as Zakat using our formula below. However, you are permitted to give your Zakat for jewelry in actual gold or silver. If your jewelry contains 100 grams of gold then give 2.5 grams of actual gold as Zakat. We Can Help You to Calculate Zakat on Gold

If your jewelry is made up of varieties of metals then the calculation would become a bit complicated. In this case, you would need to go through a few steps before calculating Zakat on your Jewelry :

- If half of your jewelry contains varieties of precious metals, and the rest of the half contains gold or silver then you are required to pay Zakat, only for the gold or silver.

- Make sure you weigh the gold, silver or other precious metals separately to get the correct calculation of the weight of gold.

- Visit a jeweler to get the approximate weight of gold, if your jewelry contains a mixture of other metals as well. Your jeweler can tell you the approximate weight of the other metals without even removing them.

- You are not required to pay Zakat on diamonds, gemstones, pearls, etc as they are exempted from Zakat.

Now that, you have followed all the previous steps, use this formula to calculate your Zakat :

Total weight of Gold-weight of the stones X price of gold X 2.5%

You may consider this example for a better understanding :

For instance, your jewelry contains 500 grams of gold. So, you will be giving 2.5% of 200 grams of gold as Zakat which will be 12.5 grams of gold. If the market value of gold is $35 per gram then you will have to pay $437.5 (12.5 x 35) as Zakat.

Use Transparent Hands Online Zakat Calculator :

Transparent Hands is a Medical Trust Organization, that is acting as an alternative solution in the Pakistani healthcare system for the poor patients. This organization is dedicated to raising funds to support emergency and crucial surgeries of the poor patients’surgeries and medical procedures for free.

Transparent Hands has worked with utmost sincerity for the betterment of public health, since its inception and has spent every collected fund for the surgeries of the poor and vulnerable population. Hence, this organization has taken the initial step to ensure that every generous giver is able to calculate his Zakat without any hassles.

Thus, Transparent Hands has introduced an online calculator to make our Zakat calculations easier. This online calculator is a simple tool where you are required to insert the following information :

- Bank Savings (amount held for 1 year)

- Credits (money owed to you)

- Loans (money you owe to others)

- Value of shares/stocks/bonds

- Amount of Gold/Silver (Monetary Value)

- Nisaab of silver

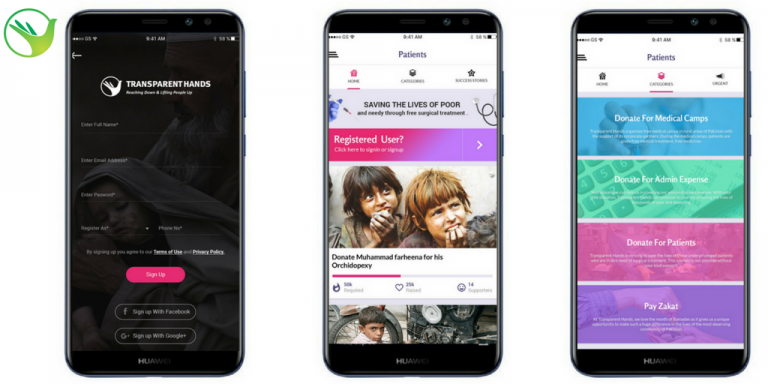

Download our Transparenthands Andriod Application for Online Donation

The online Calculator, will do the Zakat calculations for you after you have provided all the information. It is not a sin to pay more Zakat but paying less than the required amount is unacceptable.

Therefore, it is recommended to use the Transparent Hands’ online Zakat calculator to ensure that your Zakat Calculations are 100% error free.

Leave a Reply