Zakat Calculator – How to Calculate Zakat Online

Zakat means to purify one’s soul and wealth. Being the third pillar of Islam Zakat is an obligation which must be performed by all Muslims. Zakat is the systematic giving of 2.5% of one’s wealth to those in need. Zakat is essentially an act of worship through which Muslims benefit themselves as well as others and establish social justice. Zakat Calculator-How to Calculate Zakat online.

Zakat can be paid at anytime of the year and this depends on the person’s individual financial circumstances. Different people become the owners of Nisab at different times of the year so the time of paying Zakat varies for each individual. It is a common practice among people to pay Zakat during Ramadan for the increased reward, but this is not an obligation. Zakat should be paid as soon as it becomes due. As paying Zakat is an act of duty, it is unacceptable to delay it.

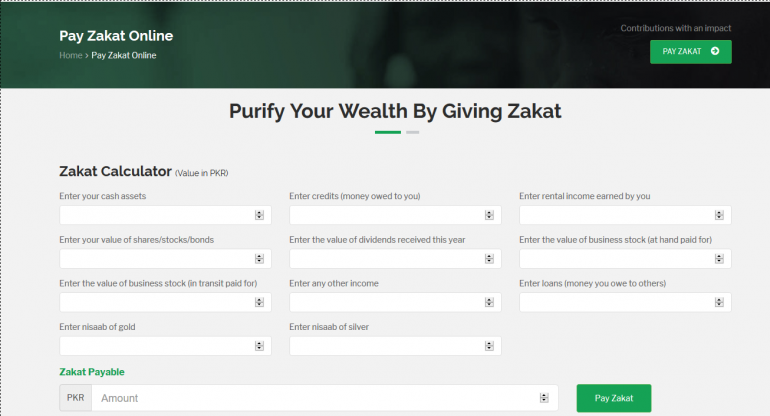

When calculating Zakat the amount owed often becomes the subject of great discussion. The simplest and easiest way to fulfill your obligation of Zakat is to use Zakat calculator to work out how much you have to pay. So we have picked a Simple and easy to use Zakat Calculator that will enable you to calculate your Zakat correctly.

Zakat Calculator – Calculate Your Zakat Online

Muslim Aid offers a Zakat calculator online that has made the entire process of calculating Zakat extremely simple and straightforward. This newly designed and updated calculator does all the calculations for you. Just enter a few numbers and the calculator will work accurately as far as possible to calculate the owed amount for you.

There are many variables involved in determining how much an individual must pay which often leads to confusion and people unintentionally overlook something or add something unnecessarily. The Zakat Calculator from Muslim Aid deducts these errors altogether and shows you exactly your Zakatable amount.

The Muslim Aid calculator can calculate amounts in US Dollars, GBP and Euros. The Nisab values are based on the values of Gold or Silver as the user chooses .While calculating it will take the values of stock options, savings, bonds and other investments into the account. While some things need to be added, some should be subtracted, such as loans and this calculator will support that.

Islamic Help also offers a Zakat calculator online which shows the updated Nisaab figure and automatically work out how much Zakat is due based on the numbers you input into the various categories.

This calculator uses two measures to determine the Nisaab which is 3 ounces or 87.48 grams of gold or 21 ounces or 612.36 grams of silver. Though it is acceptable to pay Zakat based on any of these two measures, many scholars recommend using silver because it enables more people paying Zakat which makes more funds available for beneficiaries.

To use this calculator from Islamic Help you are required to give detailed information of your assets which will be included in your Zakat calculation such as cash in hand, in bank accounts or money lent to someone, shares, pensions, value of crops, money from property investment and gold and silver. However you need not include your personal items such as your home, furniture, cars, food, and clothing in Nisaab. You can pay Zakat as a full sum or regular monthly payments.

There are many other Zakat Calculators available online which you can use to calculate your Zakat accurately. Zakat calculators save your time and only takes into account those values that falls into the Zakatable criteria eliminating confusions.

If your net yearly savings fall below the Nisaab amount you need not pay Zakat. If your net capital exceed the Nisaab value it will be mandatory for you to give zakat. Keep in mind that in addition to cash, Zakat is also owed on gold, silver, investments, rent, income, business merchandise and profits, shares, and bonds. All of these must be taken into account when calculating the Zakat amount.

Zakat is obligatory on every Muslim who is of sound mind and possesses more wealth than the Nisaab amount. You can pay Zakat at any time of the year if you know that your personal wealth is above Zakat. Keep a note of the date so that you remember when it’s due in the next year. Many people choose Ramadan as the month to pay zakat in order to seek the mercy and blessings of the Almighty. Ramadan is also one of the five pillars of Islam. It is a sacred time when Muslims are required to fast and read the Quran. Paying Zakat in this Holy month is another way to cleanse the soul and ones wealth.

thanks for information about online zakat calculator

Dear Dani,

Thank you very much for appreciating our online zakat calculator.