Calculate Zakat on Gold by Using Our Zakat Calculator

“Those who (in charity) spend of their goods by night and by day, in secret and in public, have their reward with their Lord: on them shall be no fear, nor shall they grieve.”- (Surah Al Baqarah, Verse 274) -Calculate Zakat on Gold by Using Our Zakat Calculator

Related Articles :

Zakat is the third pillar of Islam, which is made obligatory on every rich Muslim adult regardless of their age. Muslims are required to pay Zakat on the savings, assets and jewelry that are held for one calendar year and is more than the Nisaab Threshold.

Giving Zakat on Gold becomes mandatory, because it is a valuable material kept for beautification or business purposes, thus, excluded from the basic necessities for living.

You will be paying Zakat on gold whether your jewelry is used for adornment, decoration or you have received it as inheritance or gift. In short, all Muslim men or women are bound to pay Zakat on Gold regardless of its purpose.

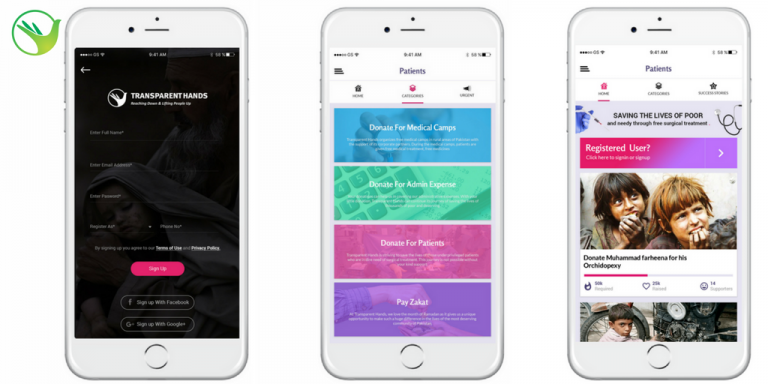

Download our TransparentHands iPhone Application for Online Donation

How to Calculate Zakat on Gold :

Calculating Zakat on gold involves some simple processes which are as followed :

Weigh your pure gold jewelry to see if it exceeds the 87.5 grams Nisaab threshold. If your jewelry weighs more than 87.5 grams then you are bound to pay 2.5% of Zakat on it.

You can either give Zakat on monetary value or give it in actual gold. For instance, if you have 125 grams of gold then give 2.5 grams of gold to a poor person as your Zakat.

You are also required to pay Zakah on the gold that you have sold during the year. For instance, if you are required to pay Zakat in the month of Rajab, but you have sold the gold before that and still have the acquired money at hand then you will be paying 2.5% of the cash as Zakat. In case, if you have spent the money before the Rajab month arrives then you do not owe any Zakat.

If your jewelry contains diamonds, pearls, ruby, palladium, silver, etc. apart from gold then take it to a well-known jeweler. A professional jeweler has knowledge about the metals and lets you know the approximate weight of metals in your jewelry without even removing the other elements. When you know the weight of the other elements in your jewelry it will become easier for you to calculate Zakat on gold.

For instance, if the gold jewelry that weighs 100 grams then you will have to give the market value of 2.5 grams (i.e. 2.5% of 100 grams) of gold as Zakat. If the market value of gold is $32 per gram then you will have to pay $80(i.e 2.5 x 32) as Zakat.

The formula for calculating Zakat on Gold is as followed :

Total weight-the weight of other stones X weight of gold X2.5%

Calculate Zakat on Gold by using Our Zakat Calculator :

Calculating Zakat on gold jewelry seems to get complicated leaving men and women confused most of the time. This happens due to the lack of precise and clear knowledge about the Shari’ah laws on Zakat.

However, Transparent Hands has introduced an online calculator to make our Zakat calculations easier. This online calculator is a simple tool where you are required to insert the following information:

- Bank Savings (amount held for 1 year)

- Credits (money owed to you)

- Loans (money you owe to others)

- Value of shares/stocks/bonds

- Amount of Gold/Silver (Monetary Value)

- Nisaab of silver

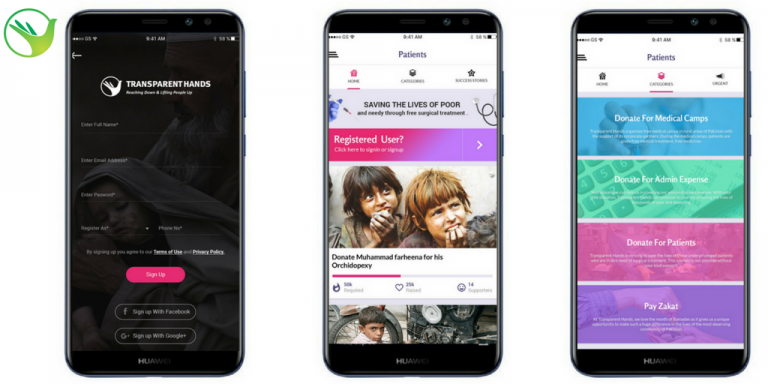

Download our Transparenthands Andriod Application for Online Donation

The online Calculator will do the Zakat calculations for you, after you have provided all the information including the monetary value of gold that you have figured out using our formula.

It is not a sin to pay more Zakat but paying less than the required amount is unacceptable. Therefore, it is recommended to use the Transparent Hands’ online Zakat calculator to ensure that your Zakat Calculations are 100% error free.

Leave a Reply