How to Calculate Zakat on Savings

Zakat is the compulsory giving of a fixed proportion of one’s wealth to charity. It is considered as a type of worship and self-purification. Zakat is one of five pillars of Islam. Zakat is not the charitable gifts given out of kindness or generosity, but it is the mandatory giving of 2.5% of one’s wealth each year to benefit the poor and the needy.

Zakat helps a person acknowledge that everything comes from the Almighty and that we do not really own anything ourselves. Zakat is a way to remind us that we cannot take anything with us when we die so we should not cling to our wealth. Zakat also helps to free oneself from the love of possessions and greed.

Calculate Zakat on bank savings:

The money deposited in the bank is of two kinds:

Money deposited in Islamic banks: The Zakat has to be paid on the capital money and on the profit. However, it is permissible to set a particular time for the payment of Zakat for each independent money.

If the amount of money decreases and drops below the nisaab during the year, there is no need to pay Zakat and you start calculating the year again. This time when the amount of money reaches the nisaab again you have to pay Zakat.

-> How to Calculate Zakat on Profit

You must pay Zakat on profits of the saved money. Zakat will be paid on the whole amount when one year has passed since the original money was acquired, even if only a few days have passed since the profit was acquired.

However if your savings money reach the nisaab amount before one year time, you will be paying Zakaah on that money because it comes under the heading of paying Zakaah in advance before one year has passed.

Money deposited in banks which deal with interest and usury: Zakat is due on the capital money only, and there is no Zakat on interest. In Islam interest is considered as the forbidden and impure money which is not the property of its owner. It is an obligation to get rid of this money by giving it to the poor and the like, and it is not permissible to deduct this money from the due Zakat.

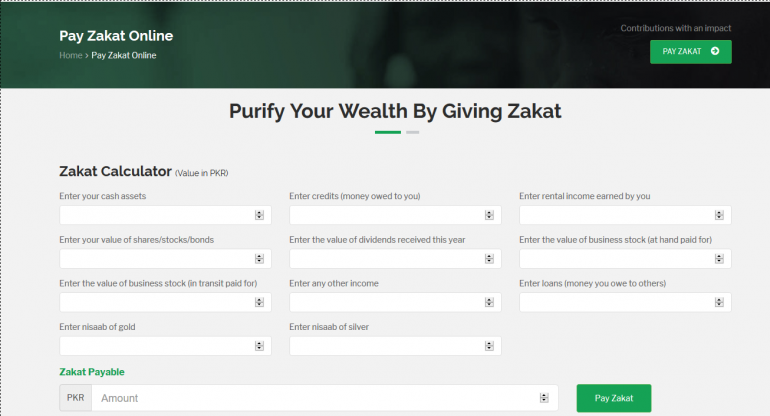

How to Calculate Zakat Amount:

Take your current savings, all cash in hand, any tradable business inventory you have, and the value of any active investments and marketable securities you have and add them together. Let’s assume the amount is 25,000 USD.

Calculate your immediate expenditure such as monthly house rent, other bills, payroll (if you have a business), insurance payments, etc. Let’s assume that adds up to 13,000.

Now deduct your immediate expenditure from your current assets, which will be 25,000 -13,000 = 12,000 USD.

To calculate Zakat now multiply 2.5% with the leftover amount: 2.5% x 12,000 USD = 300 USD is due for Zakat.

Conclusion:

Goodness is a vital part of human nature. A man feels inner satisfaction by doing virtuous deeds, like giving money to the poor and helping out a disabled person, an orphan etc. Such acts of kindness and compassion are the reasons why human race still exists on the surface of the earth. Hence, Islam greatly emphasizes the importance of doing well to others.

Islam has made kindness, compulsory upon all those who embrace faith through Zakat. As one of the pillars of Islam, Zakat is a system to redistribute the wealth of the Muslims. Zakat is one way to show our gratitude to God, in return for the many boons that we have been blessed with. Zakat helps to shape our lives and helps to develop feelings and a deeper concern for our fellow men. Zakat is a way that brings the Muslim society towards prosperity, security, and social justice.

Leave a Reply