Zakat on Jewellery

Jewelry has always been a vital part of Women’s beautification since ages. Some women adorn light jewelry on day to day basis, and keep aside the heavy ones for occasional use. Then, there are other women who may not wear jewelry on a day to day basis but would keep them as the token of love or affection. Zakat on Jewellery

Related Articles :

Jewelry is a valuable material and it is excluded from the basic necessities of life. Therefore, all kinds of jewelry that are made of gold or silver are subjected to Zakat in Islam. Every Muslim woman is obliged to pay Zakat on their jewelry regardless of her marital status. Zakat on Jewellery

There are many Muslim women who are willing to pay Zakat, but cannot do it properly due to their confusion on the various matters of the Shari’ah.

Hence, to make things easier for Zakat givers we have prepared a brief guideline regarding the ways to pay Zakat on jewelry.

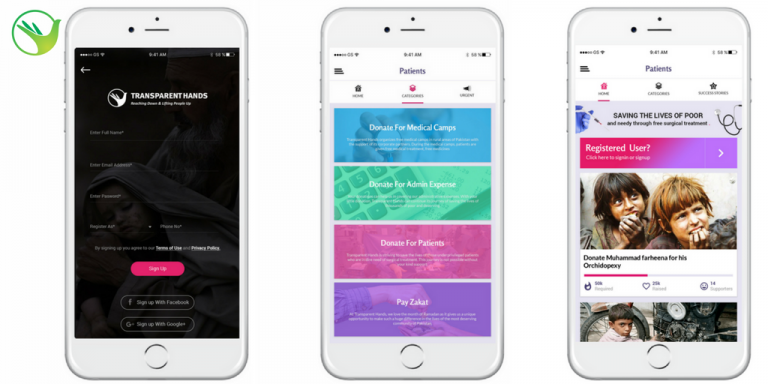

Download our TransparentHands iPhone Application for Online Donation

Nisaab on Gold and Silver :

Jewelry will be subjected to Zakat if it exceeds the Nisaab amount. The Nisaab threshold for gold is 85g or 7.2 Tolas and 612.36 grams or 85.7 Tolas for silver. However, other precious metals or gemstones like platinum, palladium, diamonds pearls, sapphires, rubies, corals, etc are all exempted from Zakat. Zakat on Jewellery

If your jewelry is made up of a mixture of gold, silver or other precious metals then you are required to pay Zakat only on the amount of gold and silver. For convenience, you can go to a jeweler and ask them to weigh the metals separately to help you figure out whether the amount of gold or silver exceeds the Nisaab threshold.

Purpose of Jewelry :

There is a common misconception, that Muslims have to pay Zakat on the jewelry that they are using for business purposes. So, many would suggest that women don’t need to pay Zakat on the jewelry they adorn every day. Now, such Fataawa’s are wrong.

Zakat is payable on jewelry as soon as it reaches the Nisaab amount regardless of its use. In short, all jewelry is subjected to Zakat without differentiating on its purpose or kind of use. Here is a short Hadith from Abu Dawud to explain this situation accurately:

“A’ishah (Ra), the wife of the Prophet (SA) says, “The Messenger of Allah (SA) entered upon me and saw bands (i.e. rings without any stones) of silver on my hand. He said, “What is this, O `A’ishah?!”

I replied, “I put them on to make myself beautiful for you, O Messenger of Allah!” He said, “Do you pay their Zakat?” I said, “No.” He said, “They are sufficient for you [as a share] of the Fire [of Hell].”

Hence, the above mentioned Hadith is sufficient to prove that Zakat is payable on all sorts of jewelry regardless of its purpose or use.

Who will pay Zakat on Jewelry ?

Zakat on jewelry is payable by its owner, which means it is obligatory on every woman to pay Zakat on their jewelry once it reaches the Nisaab amount.

If the woman is a service holder or business owner then she should pay the Zakat on her own. In case a woman is a homemaker and doesn’t have her own income source then the husband is allowed to pay Zakat on her behalf. Zakat on Jewellery

Rules of Shari’ah on Unpaid Zakat :

Many people remain confused, about whether they should pay all the unpaid Zakat of the previous years that they had missed due to ignorance. Here is a short Hadith to explain this situation accurately:

“Shaykh Ibn Baaz (may Allah have mercy on him) was asked about a woman who has jewelry for adornment that stayed with her for years but did not pay Zakat on them because she was ignorant about its regulations. Then one day, she came to know that it was obligatory for her to pay Zakah on her jewelry. Does she have to pay Zakah for the past years?

Shaykh Ibn Baaz (may Allah have mercy on him) replied: You have to pay Zakah from the time when you came to know that it is obligatory to pay Zakah on jewelry. As for the past when you did not know about that, it is not obligatory for you to pay Zakah because the rulings of Shari’ah are only binding after one comes to know of them.” (Fataawa Islamiyyah, 2/84).

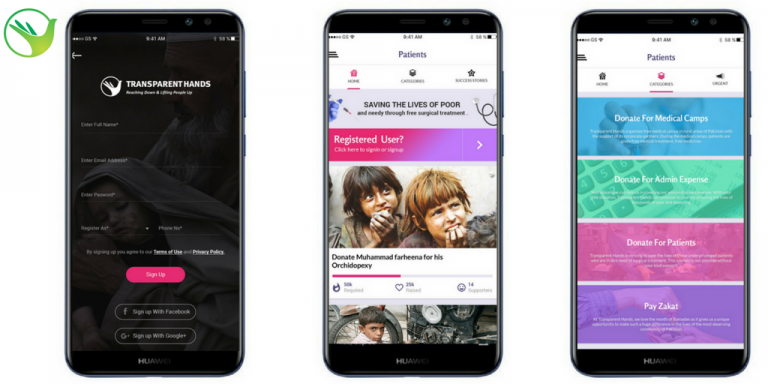

Download our Transparenthands Andriod Application for Online Donation

Islam has made things easier for its followers. Hence, all the rulings of the Shari’ah become obligatory on a Muslim the moment they come to know about it. So you need not pay Zakat for the past years that you had missed due to ignorance.

However, you will be obliged to pay Zakat on your jewelry sincerely from the time you came to know that it is subjected to Zakat.

Leave a Reply